A subscription business thrives on reliability, convenience, and trust—qualities directly tied to how payments are processed. The role of payment gateways in subscription success is fundamental, as they serve as the backbone of all recurring transactions. A payment gateway securely transfers payment data between customers, businesses, and banks, ensuring every transaction happens smoothly and securely. For subscription-based models, where recurring billing is essential, a robust payment gateway automates payments, minimizes errors, and builds customer confidence. The efficiency of this system often determines whether customers remain loyal or abandon the service.

Table of Contents

1. Importance of Payment Gateways in Subscription Models

Payment gateways form the technological link that allows businesses to collect recurring payments automatically.

- Businesses depend on gateways to handle monthly, quarterly, or annual billing cycles without manual intervention.

- Gateways protect sensitive financial data through encryption and fraud detection tools.

- Reliable gateways ensure uninterrupted revenue flow, even when large volumes of transactions occur.

- Subscribers experience seamless payments, leading to greater satisfaction and retention.

2. Core Functions of Payment Gateways

A payment gateway performs several crucial functions beyond simply processing payments.

| Function | Purpose |

|---|---|

| Authorization | Verifies if the customer’s payment details are valid and funds are available. |

| Authentication | Ensures the user is legitimate through two-factor verification or tokens. |

| Settlement | Transfers funds from the customer’s account to the merchant’s account securely. |

| Billing Automation | Handles recurring payments on preset schedules without manual work. |

| Fraud Prevention | Detects suspicious transactions and blocks potential threats. |

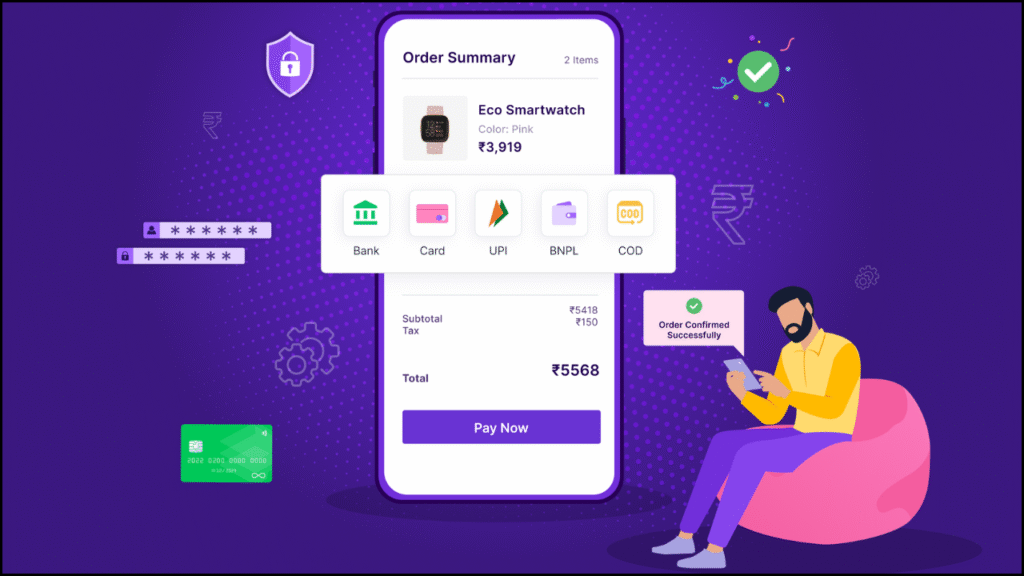

3. Enhancing Customer Experience

Customer satisfaction in subscription models heavily depends on how effortless and secure the payment process feels.

- Automated recurring billing prevents interruptions in service.

- Multiple payment options, such as credit cards, wallets, and UPI, increase customer flexibility.

- Transparent payment receipts and notifications improve trust.

- Smooth refund and cancellation processes reduce friction for customers.

4. Supporting Recurring Revenue Streams

Payment gateways directly influence the stability and predictability of subscription income.

- Automated payment retries ensure continuity when a payment fails.

- Businesses gain access to dashboards displaying real-time transaction data.

- Consistent billing reduces cash flow gaps that affect operations.

- Long-term subscribers feel confident knowing their payments are handled securely.

5. Security and Compliance Advantages

Security remains a top concern for both customers and businesses in digital transactions.

| Security Feature | Business Benefit |

|---|---|

| Data Encryption | Protects customer details during payment processing. |

| PCI DSS Compliance | Ensures adherence to global payment security standards. |

| Tokenization | Replaces sensitive card data with encrypted tokens. |

| Fraud Detection Systems | Monitors suspicious activity and blocks high-risk transactions. |

- These measures enhance brand credibility and minimize financial risk.

6. Integration with Subscription Platforms

Payment gateways integrate seamlessly with subscription management systems to automate financial workflows.

- Gateways connect directly with tools like Subitt, Recurly, or Chargebee.

- Automatic synchronization between customer data and billing cycles ensures accuracy.

- APIs allow custom integrations with CRM and accounting software.

- Unified systems reduce manual reconciliation and financial discrepancies.

7. Global Reach and Multi-Currency Support

Many subscription businesses serve international customers, making global compatibility essential.

- Payment gateways support multiple currencies and local payment methods.

- Currency conversion occurs automatically, reducing customer confusion.

- Cross-border compliance ensures smooth international transactions.

- Multi-currency support enables businesses to expand into new markets effortlessly.

8. Reducing Churn Through Payment Automation

Payment failures are among the leading causes of subscription churn, and gateways help minimize this risk.

- Automatic payment retries recover failed transactions due to expired cards or insufficient funds.

- Notifications alert customers before renewals, encouraging timely payment updates.

- Smart dunning systems schedule retries based on past success rates.

- Reduced churn improves lifetime value and customer retention metrics.

9. Simplifying Business Operations

Efficient payment gateways reduce administrative burden for subscription businesses.

| Operational Area | Impact of Payment Gateway |

|---|---|

| Billing Management | Automatically generates invoices and receipts. |

| Financial Reporting | Provides detailed transaction reports for accounting. |

| Customer Updates | Syncs payment status with CRM systems in real time. |

| Tax Compliance | Handles region-specific tax calculations during checkout. |

- Streamlined processes help teams focus on growth and marketing instead of manual financial tasks.

10. Building Customer Trust Through Transparency

Trust is the foundation of subscription success, and gateways enhance it through clear communication.

- Customers receive automated payment confirmations and receipts instantly.

- Secure branded payment pages reduce skepticism during checkout.

- Refunds and adjustments are processed efficiently, maintaining goodwill.

- Transparent policies around payment failures and renewals create long-term trust.

11. Role of Analytics in Payment Gateways

Modern gateways offer analytical insights that help businesses improve performance.

- Real-time analytics display revenue trends and failed payment statistics.

- Data visualization tools identify patterns in customer payment behavior.

- Businesses can forecast future income based on renewal rates and customer retention.

- Insights assist in optimizing pricing strategies and promotional campaigns.

12. Examples of Popular Payment Gateways for Subscription Businesses

| Gateway | Key Strength |

|---|---|

| Stripe | Offers advanced APIs and strong recurring billing support. |

| PayPal | Ideal for businesses seeking global reach and easy setup. |

| Razorpay | Popular among Indian SMBs for localized payment options. |

| Square | Integrates seamlessly with POS systems for hybrid businesses. |

| Authorize.Net | Provides reliable fraud prevention and flexible payment scheduling. |

- The choice of gateway depends on business size, geographic reach, and technical requirements.

13. Common Challenges in Payment Gateway Integration

Despite their advantages, payment gateways may pose some operational challenges if not configured correctly.

- An incorrect setup can lead to billing errors or duplicate transactions.

- Poor integration with CRM or POS systems may cause data mismatches.

- Delays in settlement can disrupt cash flow for smaller businesses.

- Lack of local payment options can reduce conversion rates in certain regions.

14. Best Practices for Using Payment Gateways in Subscriptions

Effective management ensures smooth functioning and long-term success.

- Choose gateways that support automated recurring billing and smart retries.

- Enable multiple payment methods to cater to different customer preferences.

- Regularly monitor reports for failed payments or potential fraud attempts.

- Keep systems updated with compliance and security patches.

15. Future of Payment Gateways in Subscription Ecosystems

Technological advancements are making payment gateways more intelligent and adaptive.

- Artificial intelligence will predict payment failures before they happen.

- Machine learning algorithms will improve fraud detection accuracy.

- Voice and biometric payments will create faster and more secure experiences.

- Enhanced interoperability between gateways and CRM systems will ensure real-time synchronization.

Closing Reflections

Payment gateways are the lifeline of subscription success, enabling seamless and secure recurring transactions that build customer trust and ensure predictable revenue. Their role extends beyond processing payments—they safeguard data, automate billing, prevent churn, and deliver insights that help businesses grow strategically. For subscription-driven companies, selecting the right payment gateway means gaining the reliability and transparency essential to maintaining long-term customer relationships and financial stability. A strong gateway transforms complex financial operations into a smooth, automated experience that supports continuous growth.